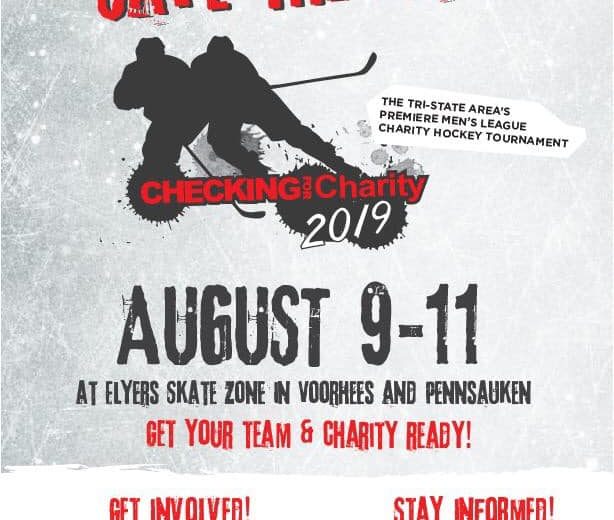

Checking for Charity 2021

The photos from this year’s Checking for Charity are in!!

Thank you to everyone who came out and cheered for Team Atlantic Insurance Services! Although we didn’t finish 1st place, we did make the playoffs this year and raised even more money for the Ronald McDonald House of Southern New Jersey!

Special thanks to all the players and coaches who gave up their time to raise money for this great charity! We can’t wait till next year’s tournament!

Special thanks to Tom Valentino for volunteering his time as our team photographer. Photo Credit: Tom Valentino.

You can also view the photos on our Facebook page by clicking the link below.

https://www.facebook.com/AtlanticInsuranceServices/posts/10165496717750574